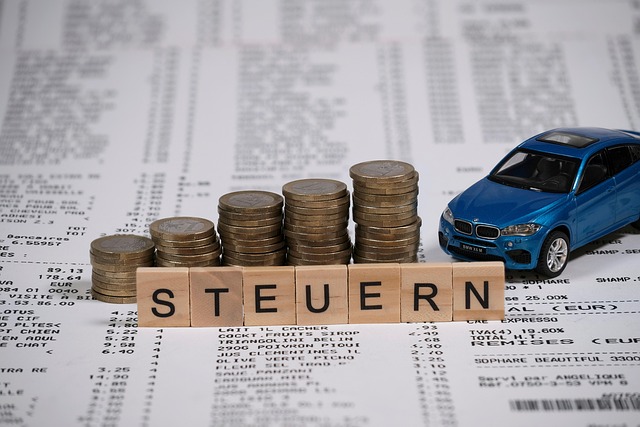

Tax arbitrage through asset reallocation optimizes tax liabilities by diversifying investments across stocks, bonds, real estate, and retirement accounts like IRAs. A study shows potential savings of 10% on taxes over time. Individual circumstances, risk tolerance, and financial goals guide portfolio construction, with regular reassessments to capitalize on changing tax laws and market conditions. This proactive approach enhances investment performance and stability for long-term success.

In today’s globalized financial landscape, understanding tax arbitrage is more than a mere academic exercise; it empowers investors and businesses to optimize their strategies. Tax arbitrage refers to the process of exploiting differences in taxation rates across jurisdictions to maximize returns on investments, with a key aspect being the strategic reallocation of assets. However, navigating this complex field requires meticulous analysis and an in-depth understanding of both domestic and international tax laws. This article provides a comprehensive guide to tax arbitrage, detailing its mechanisms, benefits, challenges, and best practices for effective asset reallocation. By delving into these intricacies, we aim to equip readers with valuable insights for informed decision-making in the dynamic world of global finance.

- Understanding Tax Arbitrage: Strategies for Savings

- Identifying Opportunities: Asset Reallocation Techniques

- Legal Considerations and Risk Management

- Implementing Arbitrage: Step-by-Step Guide

Understanding Tax Arbitrage: Strategies for Savings

Tax arbitrage offers a sophisticated approach to financial planning, enabling individuals and businesses to optimize their tax liabilities through strategic asset reallocation. This method leverages differences in tax treatments across various investment vehicles, allowing for significant savings. By understanding how different assets are taxed, investors can make informed decisions to minimize their overall tax burden. For instance, consider the case of West USA Realty, where a diversified portfolio encompassing both taxable and tax-advantaged accounts could result in substantial tax arbitrage opportunities.

The key to success lies in portfolio diversification. A well-crafted strategy involves allocating assets across various categories, such as stocks, bonds, real estate, and retirement accounts, each with distinct tax implications. For instance, traditional individual retirement accounts (IRAs) offer tax advantages by allowing contributions to grow tax-deferred until withdrawal, while Roth IRAs provide tax-free withdrawals in retirement. Effectively reallocating assets between these vehicles can create a powerful tax arbitrage strategy. A study by the Tax Foundation revealed that strategic asset allocation could potentially save investors an average of 10% on their taxes over time.

Portfolio diversification strategies should be tailored to individual circumstances, risk tolerance, and financial goals. Experts recommend reassessing and rebalancing portfolios regularly to capitalize on changing tax laws and market conditions. By incorporating tax arbitrage techniques, investors can not only optimize their tax position but also enhance the overall performance and stability of their investment portfolio. This proactive approach ensures that every aspect of a financial strategy works in harmony to achieve long-term success.

Identifying Opportunities: Asset Reallocation Techniques

Tax arbitrage is a strategic approach to optimizing one’s financial portfolio by leveraging differences in tax treatments across various asset classes. When it comes to identifying opportunities, asset reallocation plays a pivotal role in this process. This involves strategically shifting investments from one category to another within a tax-efficient framework. For instance, consider a scenario where an individual holds a significant portion of their wealth in highly taxed assets like bonds or certain types of stocks. By reallocating a part of this portfolio into tax-advantaged retirement accounts, such as IRAs or 401(k)s, they can enjoy substantial tax savings over time. This is particularly beneficial for long-term investors aiming to maximize their after-tax returns.

Effective asset reallocation requires a nuanced understanding of various investment vehicles and their respective tax implications. For instance, real estate investments, often overlooked in traditional portfolios, offer unique advantages through deductions for property taxes, maintenance, and depreciation. This can significantly reduce the overall tax burden compared to other asset classes. West USA Realty, a prominent player in the region’s real estate market, exemplifies how strategic asset reallocation can benefit investors. By diversifying into property investments, individuals can not only diversify their portfolios but also capitalize on tax efficiencies associated with this sector.

Portfolio diversification is a key strategy that goes hand in hand with asset reallocation. Diversification ensures that an investor’s portfolio isn’t heavily concentrated in any one asset class or sector, reducing risk. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and alternative investments. This can be achieved through direct investment or through exchange-traded funds (ETFs) and mutual funds, which offer instant diversification across various asset classes. By reallocating assets to maximize tax efficiency while maintaining a diversified portfolio, investors can optimize their financial strategy.

To implement effective asset reallocation, investors should regularly review their portfolios and stay informed about changing tax laws. Consulting with financial advisors or tax professionals is essential for making informed decisions tailored to individual circumstances. This proactive approach ensures that investment strategies remain aligned with one’s financial goals and tax objectives, fostering long-term wealth accumulation and preservation.

Legal Considerations and Risk Management

Tax arbitrage is a strategic approach to optimizing investment portfolios by exploiting legal differences in tax treatment across various asset classes. This method involves careful asset reallocation, where investors strategically shift holdings from higher to lower tax jurisdictions, aiming to minimize overall tax liabilities. The key lies in understanding the intricate legal considerations and risk management aspects that accompany such financial maneuvers.

From a legal perspective, tax arbitrage requires a deep dive into the complexities of international tax laws and double taxation agreements. Investors must navigate the rules governing cross-border transactions, ensuring compliance with both home and host country regulations. For instance, when reallocating assets between countries, one must consider the tax implications on capital gains, dividends, and interest. West USA Realty, a leading real estate firm, emphasizes the importance of professional advice in this regard, stating that “a comprehensive understanding of local tax laws is crucial for successful international investment strategies.”

Risk management plays a pivotal role in tax arbitrage. While asset reallocation can yield significant savings, it also presents potential pitfalls. Volatile currency exchange rates and political risks in foreign markets can impact the success of these transactions. To mitigate these risks, investors should employ diverse portfolio diversification strategies, spreading investments across various asset classes and jurisdictions. This approach not only enhances overall portfolio resilience but also provides a buffer against unexpected market shifts. By combining tax-efficient investment choices with robust risk management, investors can maximize the benefits of arbitrage while minimizing potential drawbacks.

Implementing Arbitrage: Step-by-Step Guide

Tax arbitrage is a powerful strategy for maximizing returns and optimizing your investment portfolio. Implementing arbitrage involves identifying opportunities to offset taxes while strategically reallocating assets, ultimately enhancing overall performance. This step-by-step guide will equip investors with the knowledge to navigate this sophisticated process effectively.

The first step in executing tax arbitrage is understanding your tax liability across various asset classes. Different investments are taxed differently—be it long-term capital gains, dividends, or interest income. A comprehensive review of your portfolio’s composition and historical performance allows for strategic decision-making. For instance, let’s consider a high-income investor with a diverse portfolio including stocks, bonds, and real estate investment trusts (REITs). By analyzing the tax rates associated with each asset class, they can identify opportunities to minimize their overall tax burden.

Next, focus on portfolio diversification as a core strategy for arbitrage. A well-diversified portfolio reduces risk and offers multiple avenues for tax optimization. Consider reallocating assets into tax-efficient vehicles such as index funds or exchange-traded funds (ETFs), which often have lower capital gains distributions. For example, West USA Realty, a prominent investment firm, emphasizes the benefits of asset reallocation through strategic diversification, enabling investors to mitigate taxes while capturing market opportunities. Additionally, exploring tax-advantaged accounts like IRAs or 401(k)s can significantly enhance post-tax returns.

Finally, implement arbitrage strategies with a long-term perspective. Tax laws and regulations can change, so staying informed is crucial. Regularly review your portfolio’s performance, taking into account market fluctuations and tax policy updates. By adopting a proactive approach, investors can ensure their strategies remain effective and aligned with their financial goals. Remember, successful tax arbitrage involves careful planning, knowledge of investment options, and an adaptable mindset to navigate the dynamic landscape of taxation and asset management.